Implementing the Gordon Model for rE -ģ.8. Two Approaches to Computing the Firm's Cost of Equity, rE -ģ.7. Calculating the Weighted Average Cost of Capital (WACC) -ģ.2.Computing the Value of the Firm's Equity, E -ģ.3.Computing the Value of the Firm's Debt, D -ģ.5.Computing the Firm's Cost of Debt, rD -ģ.6.

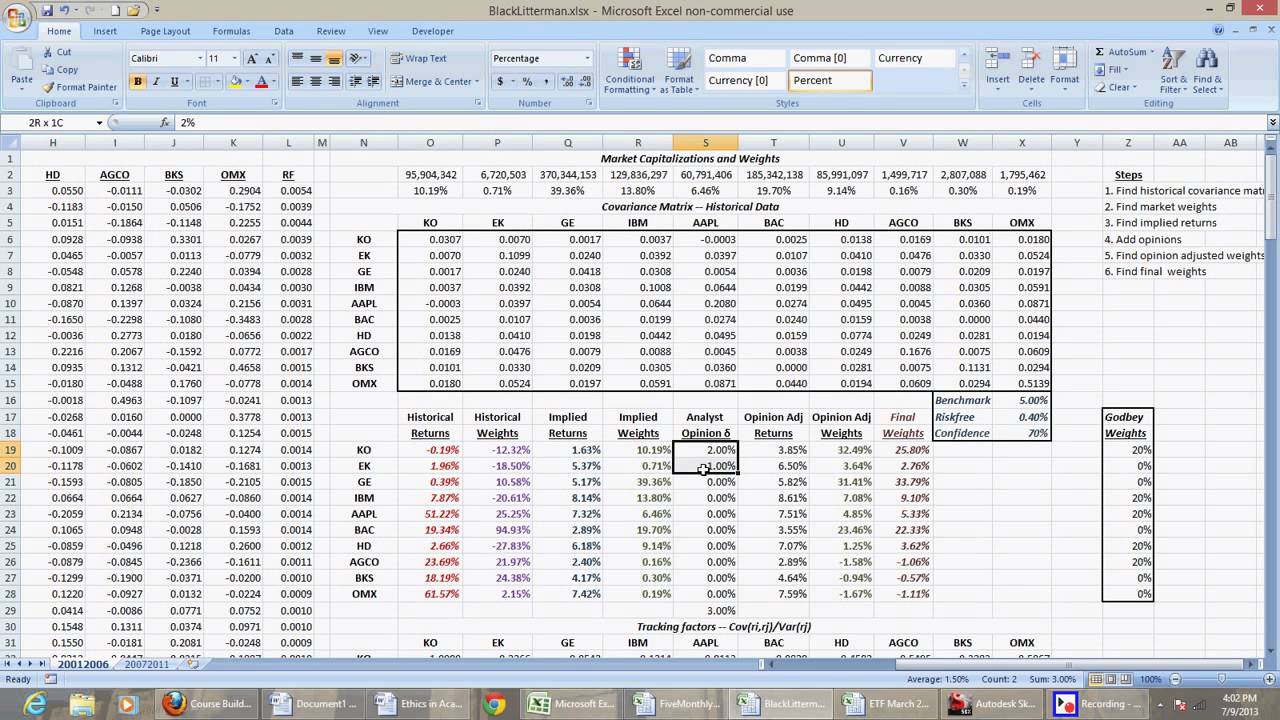

BLACK LITTERMAN MODEL EXCEL WITHOUT VBA PRO

Free Cash Flows Based on Pro Forma Financial Statements -ģ. ABC Corp., Consolidated Statement of Cash Flows (CSCF) -Ģ.8. Free Cash Flows Based on Consolidated Statement of Cash Flows (CSCF) -Ģ.7. Enterprise Value (EV) as the Present Value of the Free Cash Flows: DCF "Top Down" Valuation -Ģ.6. The Efficient Markets Approach to Corporate Valuation -Ģ.5. Using Accounting Book Values to Value a Company: The Firm's Accounting Enterprise Value -Ģ.4. Four Methods to Compute Enterprise Value (EV). Multiple Internal Rates of Return -ġ.7.A Pension Problem-Complicating the Future Value Problem -ġ.9. The Internal Rate of Return (IRR) and Loan Tables -ġ.4. Present Value and Net Present Value -ġ.3. Recording Getformula: The Windows Case -Ġ.9. Do You Have to Put Getformula into Each Excel Workbook? -Ġ.8.

BLACK LITTERMAN MODEL EXCEL WITHOUT VBA HOW TO

How to Put Getformula into Your Excel Notebook -Ġ.4.

This book is the standard text for explaining the implementation of financial models in Excel.

0 kommentar(er)

0 kommentar(er)